Thinking in Second-Order Effects: The AI Investment Playbook

The chip manufacturers are winning today. But who wins tomorrow?

The Acceleration of Adoption

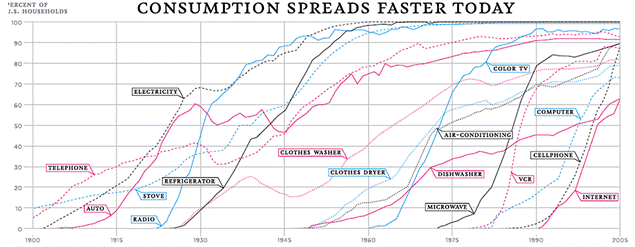

Diffusion, the process by which an innovation spreads through society, has been accelerating dramatically. A 2008 New York Times analysis revealed a striking pattern: every major innovation follows the same S-curve trajectory of a slow ramp-up, rapid adoption, then plateau. But the time to reach mass adoption keeps shrinking.

Source: NY Times – Archive

The landline telephone took nearly 50 years to reach 60% of U.S. homes. The internet achieved the same penetration in less than 15 years. The smartphone? Even faster, reaching 60% adoption in approximately six years after the original iPhone launch in 2007.

This acceleration isn’t just about better technology; it’s also about connection. As the world becomes more networked, exposure to innovation becomes nearly instantaneous.

We’re seeing this pattern repeat with artificial intelligence, but at an unprecedented scale and speed. According to Menlo Ventures, 61% of American adults have used AI in past six months as of mid-2025, and 19% use it daily. Daily usage rates are likely to surge in the coming years as the technology moves from experimentation to habit formation.

Beyond the Obvious: Why Second Order Effects Matter

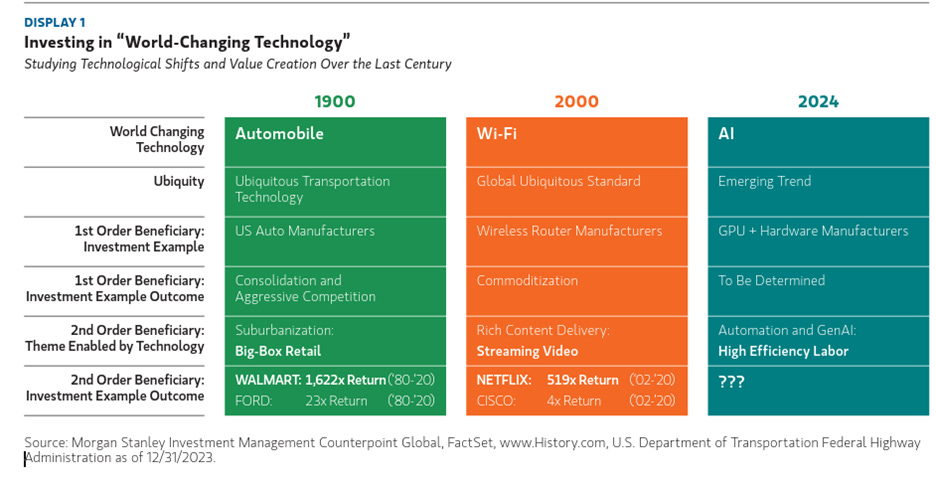

When a transformative technology emerges, investors rush toward the obvious winners. In the AI boom, that’s been GPU manufacturers and chip architecture companies. These first-order beneficiaries have captured tremendous value.

But history teaches us a crucial lesson: the long-term outcome for any disruptive technology’s initial winners remains uncertain. Capitalism has a way of competing away early advantages. What endures, and often creates the most lasting wealth, are the second-order effects.

Morgan Stanley Investment Management highlighted analogues from the Automobile and Wi-Fi revolutions to illustrate this pattern.

Consider the internet. The router manufacturers of the 1990s enjoyed their moment. But the real fortunes were made by companies that only existed because of the internet: Amazon, Google, Netflix, Meta. The infrastructure providers were first-order winners. The platform builders were second-order victors.

AI will likely follow a similar pattern.

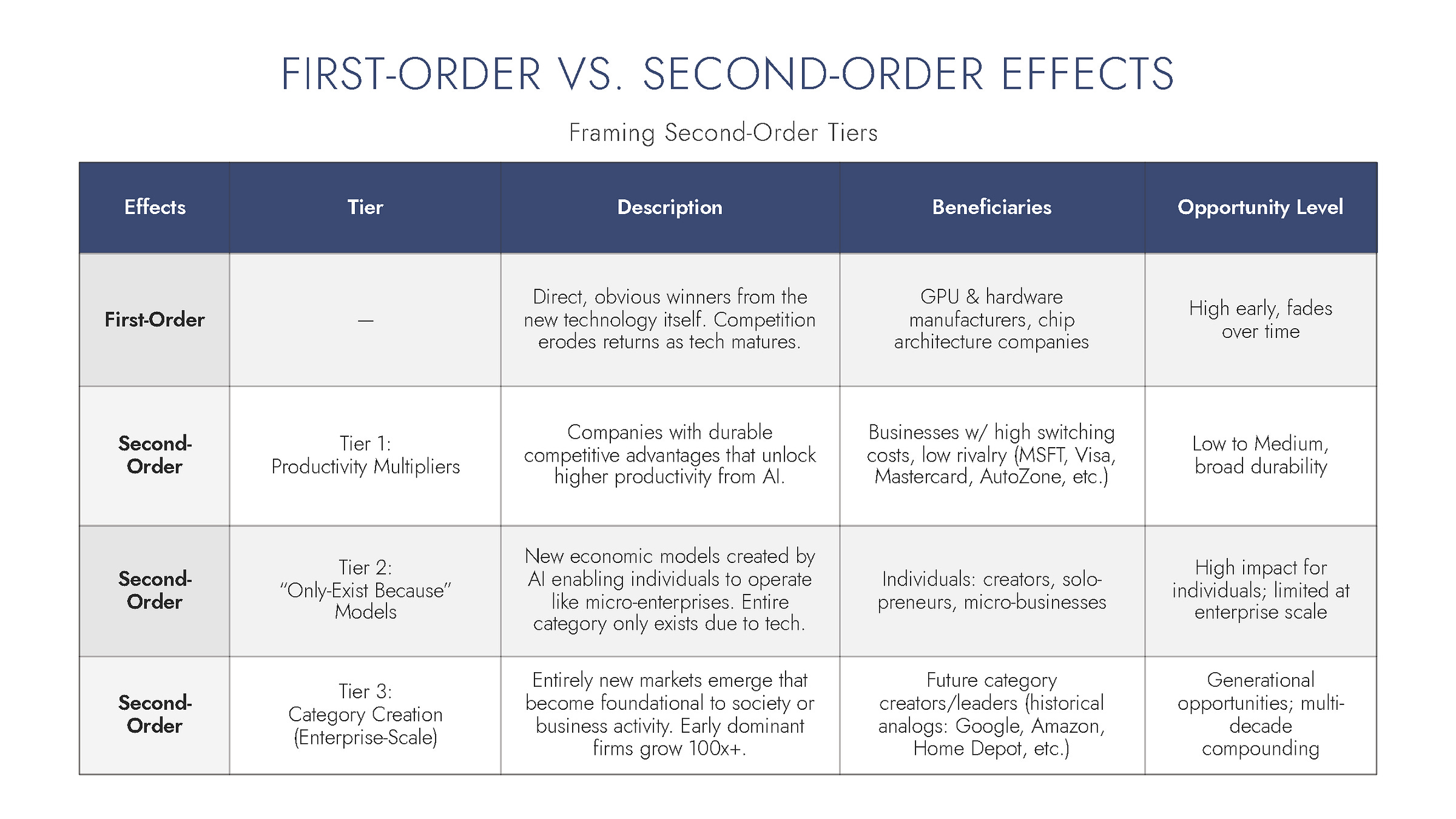

The Three Tiers of AI Second-Order Effect Investment Opportunity

Tier 1: Productivity Gains (Low to Medium Benefit)

The most immediate second-order effect of AI will be significant productivity gains across both blue-collar and white-collar labor. But not all companies will benefit equally from these gains.

In “BarbAIrians at the Gate: The Financial Opportunity of AI,” Alex Rampell distinguishes between “bits” businesses (purely digital operations) and “atoms” businesses (those with physical components). Bits businesses will likely cut costs more aggressively at first, while atoms businesses may see more marginal gains.

In either case, the winners will be companies with existing competitive advantages, particularly those with:

High switching costs: Take Microsoft, a bits business that is deeply embedded in workflows worldwide. Absent a disruptive shift in how people work, Microsoft will benefit from customer reluctance to switch platforms. As it automates many functions, the efficiency gains will accrue directly to Microsoft’s bottom line. Consider how AI could replace back-office support calls, a perfect example of bits-based cost savings.

Low rivalry industries: Consider Visa and Mastercard, both bits businesses operating as an effective duopoly with massive moats. When AI improves their operational efficiency, they won’t need to fully compete away those gains through price wars. The same logic applies to the auto parts oligopoly (atoms businesses): AutoZone, O’Reilly, and Advance Auto parts operate in a rational, low-rivalry environment where AI-driven efficiency translates to margin expansion.

Investment approach: Overweight companies with existing competitive advantages and low immediate competitive threats. These businesses will quietly compound their AI-driven productivity gains.

Risk-reward profile: This is the lowest-risk, most predictable AI investment thesis. You’re betting on good companies becoming more efficient, not on massive disruption. However, massive disruption remains a risk for these staid companies.

Tier 2: “Only-Exist-Because” Companies (High Benefit for Individuals, Small for Enterprises)

This tier represents businesses and income streams that only exist because AI makes them possible.

Consider the parallel: influencers only exist because social media democratized content distribution. Before Instagram and YouTube, you needed traditional media gatekeepers to build an audience. Social media eliminated that bottleneck.

AI is creating a similar unlock for “solopreneurs.” Tasks that previously required teams for coding, design, copywriting, data analysis, and customer service can now be handled by one person augmented by AI.

Real-world example: A solopreneur could build a business that monitors news in real-time, generates relevant meme designs, and automatically lists them for sale on print-on-demand platforms. The entire operation, from trend identification, design, copywriting, to listing creation, could run with minimal human intervention.

As coding becomes accessible through natural language, and as design and market research processes become automated, what was once impossible for a single person becomes not just possible but scalable.

Investment approach: This tier is less about enterprise investing and more about individual opportunity. The beneficiaries are people who can move quickly, experiment rapidly, and capture emerging micro-markets.

Risk-reward profile: High potential for individuals, but these businesses often remain small and transient. They represent income streams, not venture-scale opportunities.

Tier 3: Category Creation (Generational Opportunity)

This is where generational fortunes are made but the path requires imagination, patience, rigorous A/B testing, and “being stubborn on vision and flexible on details” - to quote Jeff Bezos, CEO of a generational winner from the last great tech wave.

Throughout history, the companies that created entirely new categories often became the dominant players in those categories for decades.

Coca-Cola didn’t just sell a drink; it created the soft drink category

Gillette invented the safety razor and the razor-and-blade business model

Home Depot created the big-box home improvement category

Microsoft defined PC operating systems

Google set the standard for what search means

Amazon defined e-commerce at scale

Salesforce pioneered cloud CRM

Uber created ride-hailing

Nvidia created “the world’s first GPU”

Notice a pattern: these companies didn’t compete in existing categories. They created new categories and became synonymous with them.

While it may feel strange to consider this now, the categories that will define the 2030s and 2040s are being built right now as AI spawns entirely new categories - industries and use cases that don’t exist today and aren’t readily apparent yet.

Investment approach:

This requires long-term thinking. You need to identify category-creating companies. Those that play in the infant stage (pre-IPO) will benefit greatly. However, even as these companies go public, there is still a significant potential to compound for generations.

Risk-reward profile: This is where 100x returns happen. It’s also where you can experience intense drawdowns if companies don’t prosper. The risk of taking an oversized position includes both outright loss of capital and opportunity cost if you miss other winners.

Ultimately, success requires portfolio construction that embraces volatility, accepts failures, and gives winners room to run for decades.

What I’m Watching

For Tier 3, I’m focused on two types of companies:

AI-native companies solving problems that couldn’t be solved before: Not companies adding AI features, but companies whose entire existence depends on AI making something newly possible.

Businesses exhibiting the spark of a network effect: Where each customer makes the product better, and AI accelerates that flywheel.

These companies may not use “AI” in every sentence. They’re just building something that couldn’t exist without it.

Over time, this list will evolve but I believe it’s critical to have a framework to build from.

The Bottom Line

The chip manufacturers are having their moment. But the fortunes of 2040 may not come from the companies selling the shovels. They will likely come from the companies building entirely new gold mines.

Second-order thinking has historically been the key to capturing generational wealth.

The critical question is: are you playing in the right tier, and do you have the conviction to stay there long enough to win?

Thanks for the comment, Rainbow Roxy. I think the solo-preneur will be one of the most profound changes in our society. Meaning, individual's creativity can be brought to life in a matter of days, as opposed to legacy infrastructure like agents, studios, publishers. From an investor standpoint, spending lots of time trying to figure this out!!! More to come on that front.

Couldnt agree more, your analysis on the accelerating adoption curve is spott on; what transformative second-order effects are you seeing next?